The CDN shake-up: What issues lie at the heart of a recent spate of acquisitions and exits?

The spate of consolidation and exits within the CDN market over the last few years is not unexpected for keen watchers of this space – although the most recent departure by Lumen highlights that even established players are not immune.

The recent list of moves and changes starts with the acquisition by Limelight of Edgecast from Yahoo in 2022, while StackPath decided to exit the CDN business this August, and Lumen followed suit just a month later. Both companies stated they wanted to refocus on core business, although Lumen has been in a difficult financial position for a long time, losing 94% of its stock value over the last five years. A select group of customers affected by the recent departures were acquired by Akamai – a company that, over the last two decades, has acquired rivals in the space include Speedera, Contendo and Linode.

All this market jostling is chasing a prize that is growing larger. Today, 70% of all internet traffic (by volume) is delivered through CDNs and depending on which analyst firm you follow, the CDN market is worth around $16 billion annually with a 20+% CAGR. So why are some companies walking away?

Is the CDN model working?

Both StackPath and Lumen assessed that their CDN line of business was not sufficiently profitable or strategic for their future success. The pressure on media delivery pricing across the industry in recent years undoubtedly contributed to the erosion in margins for all CDNs. In addition, a new wave of emerging use cases around edge cloud, IoT and volumetric content is also forcing CDNs to invest in new networking and edge computing hardware – a further unwanted CAPEX for these struggling content delivery companies.

However, this does not mean the CDN business is somehow flawed. It simply means a new approach is needed to succeed. As a counter-example, Akamai and rival Cloudflare have deliberate strategies to build their respective security services businesses to strengthen customer relationships and overall profitability. For Akamai, this has helped drive its stock up by 34% over the last year. But it is still hampered by a fundamental weakness that many others in the CDN space face … slimmer margins.

According to analyst firm Macrotrends: “Akamai Technologies net income for the twelve months ending June 30, 2023 was $0.478B, a 21.66% decline year-over-year. Akamai Technologies annual net income for 2022 was $0.524B, a 19.64% decline from 2021.” And remember, unlike StackPath and Lumen, who viewed CDN as “non-core,” this is very much the whole fruit for Akamai. The financial reporting is still a hard truth for Akamai, which has made a remarkable transition to focus more on higher-margin security services, today comprising more than 30% of its total revenue. The market clearly values what Akamai is doing, but the road is hard nonetheless. The problem is not the brand, technology, or the people; it’s the fundamental business model that is vulnerable.

How Qwilt is different and why that matters!

Qwilt is successfully executing its strategy to build the world’s largest edge network by partnering with service providers to leverage their vast reach, proximity, and considerable base of consumer and enterprise customers. Once deployed, service providers become both network infrastructure and selling partners with Qwilt in their respective regions. With over 150 service provider partners and 900+ points of presence globally, Qwilt has built and now operates the largest all-edge network in the world. Crucially, this is a true partnership with operators instead of a rivalry to these ISP networks that deliver last-mile Internet traffic to end users.

Qwilt’s model was designed through nearly a decade’s-long industry collaboration within the Streaming Video Technology Alliance (SVTA), to which all members of the application and content delivery value chain have contributed. The outcome is a comprehensive set of Open Caching specifications with broad industry support. Given the open nature of these specifications, service providers and content publishers eagerly embrace this model because it does not lock them into a proprietary, black box platform and, instead, offers them visibility and control over the platform and services.

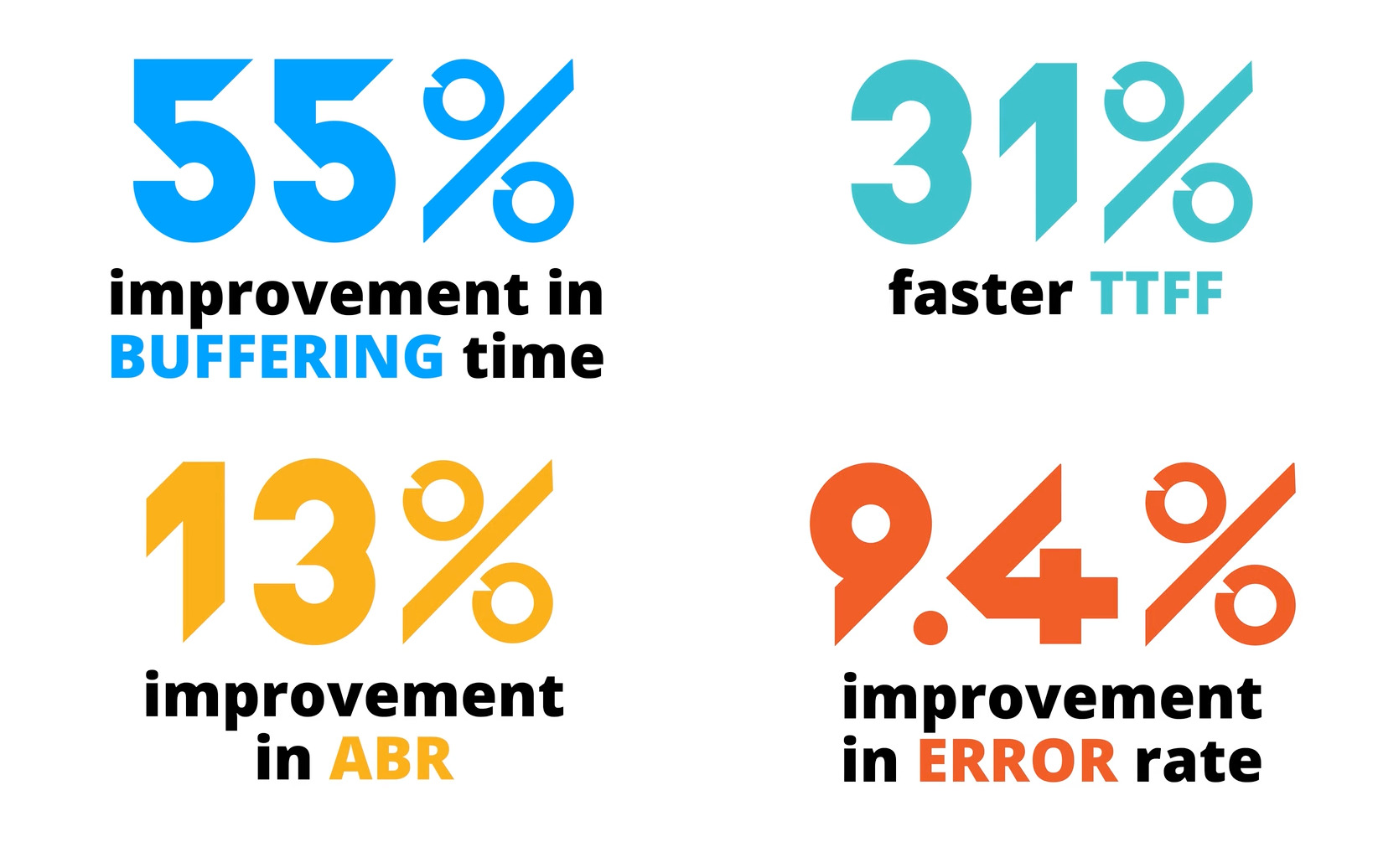

Service providers are especially eager to deploy and support the platform because Open Caching elevates them into the value chain and enables them to monetize their edge cloud services. Qwilt’s Open Edge platform performs exceptionally well in CDN use cases. We have the data (see below) that proves we outperform the industry in all forms of media delivery.

Qwilt Outperforms All Other CDNs

Global streaming platform comparison of six CDNs

during live sporting event (US, 2022)

Qwilt’s financial performance is vastly different than a traditional CDN, as we rely on the resources of service providers for the network and compute infrastructure needed for application and content delivery. This means Qwilt can focus on the software, cloud services, and APIs needed to unite all the service provider infrastructure into a single, federated, global edge network. Qwilt sees content delivery as the first use case for our Open Edge and a great way to demonstrate our differentiated performance to content and application providers worldwide.

Where do we go from here?

Savvy content providers are rightly demanding a multi-CDN environment to provide more capacity and high-quality content delivery to their customers, as well as flexibility for themselves. As more companies walk away from the CDN business, Qwilt’s unique approach offers a reliable solution for today’s OTT streaming services, with an easy path to future applications.

Many more use cases come from our Open Edge – from enterprise security, collaboration, and networking to IoT. The long-term mix of services will optimize the revenue potential of Open Edge and reward service providers who share in the revenue generated on the platform. Qwilt is here to stay and committed to using our vast edge network for media delivery and other emerging services.

Qwilt has reimagined the CDN model in several meaningful ways, putting us on a very different trajectory than traditional CDNs.

If you want to learn more about Qwilt’s unique approach to content delivery, feel free to book some time with us. We look forward to a chat!

Ready to take the next step?

We have a team of content delivery experts ready to answer your questions.

Related resources

Press Release

PROEN elevates digital experiences across Thailand with deployment of Qwilt and Cisco’s Open Caching-based CDN

Press Release

Qwilt spotlights Open Caching’s all-edge network success at IBC 2023

News

New-age CDN: Optimising the streaming experience and securing content delivery

News

How sports streaming can keep up with growing audiences

White paper